In 2024, the profitability of photovoltaic glass will continue to rise. Supply and demand balance drives the healthy development of the industry.

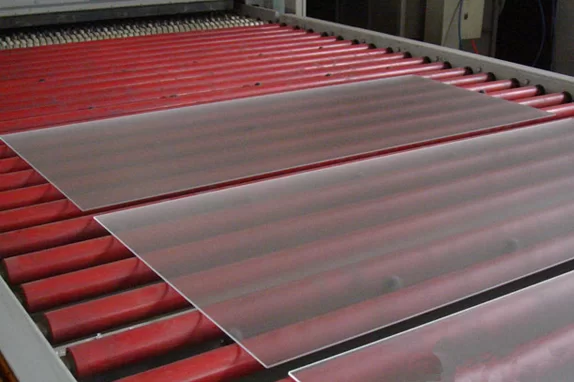

In recent years, China's photovoltaic industry has flourished, and photovoltaic glass, as a key raw material for photovoltaic components, has attracted considerable attention in the market. Under the dual push of favorable policies and market demand, the photovoltaic glass industry has ushered in new development opportunities. This article analyzes the development trend of the photovoltaic glass industry in 2024, as well as the factors that enhance the profitability of photovoltaic glass, such as cost reduction and improved supply and demand, to showcase the bright prospects of the photovoltaic glass industry.

I. Photovoltaic Glass Industry Ushers in Policy Favorability

In recent years, the Chinese government has attached great importance to energy security and sustainable development issues, and photovoltaic power generation, as one of the clean and renewable energy sources, has received strong support from national policies. With the continuous advancement of photovoltaic power generation technology and the sustained reduction in cost, the photovoltaic industry has become one of China's industries with international competitive advantages. As a key raw material for photovoltaic components, the market demand for photovoltaic glass has been increasing year by year.

II. Photovoltaic Glass Capacity Steadily Grows

According to industry reports, Flatgroup Glass had a total capacity of 20,600 tons per day by the end of 2023. In addition, the Anhui Phase IV project and the Nantong project, with 8 units of 1,200 tons each, have a total daily melting capacity of 9,600 tons per day, and are expected to start up and operate in stages this year. By the end of 2024, the company's nominal capacity is expected to reach approximately 30,200 tons. Considering the ramp-up of capacity, it is expected that actual output will increase by 20-30% in 2024, while the 9,600-tonne new production line will contribute to the full-year output in 2025. In the long term, four 1600-tonne bases in Guangxi Beibu Gulf, Sichuan Yibin and Jiangsu Lianyungang are currently undergoing the process of public hearings; a 1600-tonne capacity line in Vietnam and two 1600-tonne capacity lines in Indonesia are expected to start up in 2026 or later. The company's significant industry leadership and its active expansion efforts both at home and abroad will provide strong support for sustained growth in its performance.

III. Cost Downward Trend Helps the Solar Glass Profit Recovery

In recent years, the solar glass industry has gone through capacity overhang, price wars, etc., leading to a decline in the profitability of enterprises. However, with the slowdown in capacity growth, policy factors, and the efforts of enterprises to reduce costs, the profitability of the solar glass industry has gradually improved.

1. Slower Capacity Growth: Under the influence of policies, the capacity growth of the solar glass will continue to narrow in the future.

2. Growing Industry Demand: In the future, the growth rate of glass capacity may approach the global photovoltaic installation growth rate.

3. Reducing Costs: Companies reduce costs by optimizing procurement and improving production processes. This enhances the competitiveness of the solar glass. Additionally, projects approved may be concentrated in regions with lower energy consumption pressure, which helps reduce production costs.

IV. Improving Supply and Demand Drives Rising Prices of the Solar Glass

Benefiting from the post-holiday demand boost for solar module start-ups, the solar glass inventories declined significantly in March, thereby driving a modest price increase of 0.5-1 yuan/square meter in April, according to data from Longzhong Information. The mainstream price of 3.2mm thick glass is 26.5 yuan/square meter, while the mainstream price of 2.0mm thick glass is 18.5 yuan/square meter. It is expected that the overall price of the solar glass will remain stable, and the upward profit space mainly comes from the downward adjustment of caustic soda prices and the off-season gas prices. It is expected that the profit of the solar glass will still show significant growth on a year-on-year basis. Looking ahead to the full year of 2024, it is expected that the industry's demand will grow by 20%, while the supply of capacity will grow by 20-25%. As new capacity is released, supply and demand will be slightly relaxed, and the price of the solar glass may come under downward pressure. However, benefiting from the downward movement of natural gas and caustic soda on the cost end, it is expected that the profit of the solar glass will remain stable on a year-on-year basis.

V. Industry Competition Landscape Optimization

The competition landscape in the photovoltaic glass industry is changing, with some small and medium-sized enterprises gradually exiting the market due to shortcomings in funding, technology, etc. Industry consolidation is conducive to improving the overall industry concentration rate and optimizing resource allocation, thereby enhancing the market competitiveness of photovoltaic glass enterprises.

Conclusion

In summary, with the support of favorable policies, growing market demand, declining costs, and improved supply and demand, the profitability of the photovoltaic glass industry is expected to continue improving in 2024. Photovoltaic glass companies should seize the opportunities presented by the industry's development and enhance their competitiveness to lay a solid foundation for the sustainable development of the industry. At the same time, industry regulatory policies and technological innovation are also key factors affecting the development of the photovoltaic glass industry, and deserve attention.